Casual contracts

A ‘casual’ is an employee who is engaged on a daily basis i.e. he is engaged for one day at a time and he is paid at the end of the day.

To most people a ‘casual’ is an employee who is engaged on a need basis and who is not in permanent employment. As long as the person is not paid at the end of the day, he is not a ‘casual’ under the Employment Act, at best, such an employee is a temporary or short term employee.

The most pertinent provisions on casual employees are those that deal with their conversion to permanent employees.

If a casual employee works for a period (whether continuous or not) of not less than one month or where a casual performs work which will take three months or more to complete, the casual cannot be terminated unless he is given not less than one months’ notice. This is a departure from the normal rules of engagement of a casual which provide that the casual contract ends automatically at the end of each day. This is what is referred to as ‘conversion’ of a casual.

The Act goes further to provide that a casual employee whose contract has been converted and who works continuously for two months or more from the date of employment as a casual shall be entitled to the same terms and conditions of service as the other non-casual employees.

Is the answer to avoiding conversion to break the service? Nope! the conversion will happen whether or not the employee is working continuously, as long as the casual works for a period (whether continuous or not) of not less than one month or where a casual performs work which will take three months or more to complete.

From the wording of the Act, if the casual does not work continuously for two months, much as he will be entitled to notice prior to termination, he will not be entitled to the same terms and conditions of service as the other non-casual employees.

A casual employee must not be paid less than the prescribed daily minimum wage, this normally changes every year; current rates can be found at http://www.africapay.org/kenya/home/salary/minimum-wages.

Dynamic Lists with Excel Tables and Named Ranges

Data Validation lists are drop-down lists in a cell that make it easy for users to input data. If you’ve never worked with data validation lists before, I suggest you start with this tutorial for creating drop-down lists in cells before moving on.

In today’s post, I want to show you how to make your drop-down list dynamic. In other words, your list can automatically be updated with new options when you add or subtract entries to your source range.

This is done in three simple steps:

- Formatting the source range to be an Excel Table.

- Naming the range.

- Telling the Data Validation rules to pull the named range as your source.

I’ll explain in more detail below.

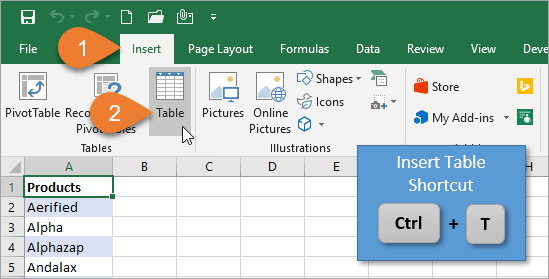

Step 1 – Format the Source Range as a Table

To begin, we will format our source range to be an Excel Table. On the Insert tab, you’ll chose the Table button. The keyboard shortcut for inserting a Table is Ctrl+T.

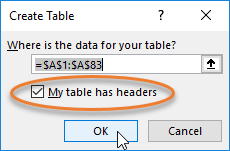

The Create Table window will appear, showing the range of cells that will be in your Table. Since our column begins with a header (“Products”), we want to make sure the checkbox that says “My table has headers” is checked. If we don’t check that box, the column title will be included in our source range and will appear as one of the options in our drop-down list.

If you haven’t used Tables before, I recommend checking out my Excel Tables Tutorial Video.

Dynamic Lists with Excel Tables and Named Ranges

Martin Wise

August 31, 2018

Martin Wise

August 31, 2018

Martin Wise

August 31, 2018

Martin Wise

August 31, 2018

You may not have millions of shillings in the bank to start a

business, but that doesn’t mean you don’t have any options. Let me

surprise you. There are so many ideas you can explore with next to

nothing and make serious returns out of them.

All that is required of you is to provide the skills, work ethic and a

bit of marketing. In short, that is what is called “sweat capital”. In

the world of start-ups, “sweat capital” is worth more than monetary

capital.

Enough of vague statement. Let’s get practical. Here is a run-down of

10 business ideas that require very little monetary capital to set-up.

Read through them keenly, take some notes and then go out there and do

some deep digging and you are ready to go.

10.Making homemade strawberry jam and selling (Budget: Ksh750)

This is an interesting idea because you can actually start it with

less than the cash you spend when you take your girlfriend for a movie

at iMax. The more creative you are the more income you can generate from

it. To start you will require some strawberries, sugar and lemons.

You will also need a sufuria (pot), mwiko (wooden stick) and some

plastic containers for packaging. With just a little more perfection,

you can actually secure a KEBS license and start supplying supermarkets.

If you can keep investing more time and creativity into this, there is

no reason why you should not grow it into a sustainable business.

| Budget Breakdown | Cost |

|---|---|

| Strawberries | Ksh250 per kilo |

| Sugar | Ksh100 for 500 grams |

| Lemons | Ksh100 |

| Packaging pouches | Ksh200 |

| Transport expenses | Ksh100 |

| TOTAL | Ksh750 |

One kilogram of strawberries will give you approximately 6 cans of

jam each weighing 250 grams. You can then sell a 250 gram for Ksh200

making at least Ksh1,200. Note that you can always expand your profit

margins by planting the strawberries yourself. Learn more.

9.Selling wall papers (Budget: Ksh1,800)

If making strawberry jam sounds more like a “mboche’s” idea to you,

then you might want to put your in-born interior design knowledge to

good use. Most people live in houses with a dull paint done by their

landlords. A number of them would like to have the exterior looking

better – but without necessarily repainting it.

This is where wall papers come in handy. You simply get ready-made

wall papers either from local wholesalers or by importing from countries

such as china.

| Budget Breakdown | Cost |

|---|---|

| Wall Paper Roll | Ksh1,600 per 10 meters |

| Other expenses | Ksh200 |

| TOTAL | Ksh1,800 |

You can then sell each roll for Ksh3,500 and include a Ksh1,000

charge for installation. That translates to more than double profit. The

more aggressive you are, the more sales you can make and the more

revenue you can generate from this.

8.Distributing black coffee (Ksh6,600)

If you live in towns like Nairobi, I am sure you have come across

some guys who distribute black coffee in matatu termini. Have you ever

stopped to inquire how much they make per day? Well, at it turns out,

this venture is one of those “opportunities dressed rags” kind of

things.

For starters you will require a 10 litre capacity flask, some disposable plastic cups and well…a bit of hard work.

| Budget Breakdown | Cost |

|---|---|

| Thermos Flask | Ksh5,000 for 10 litre thermos |

| Disposable plastic cups | Ksh1,000 |

| Sugar | Ksh400 per Kilo |

| Coffee | Ksh200 |

| TOTAL | Ksh6,600 |

As long as you are willing to give it your best, there is no reason

why you should walk away with less than Ksh1,000 per day in profits.

How? You might want to ask. Well, a 10 litre coffee thermos contains 65 x

150ml cups of coffee. Sell each cup at Ksh10 and you will make Ksh650

per flask.

10 Simple Ideas You Can Start With As Little As Ksh1000 Capital

Martin Wise

August 31, 2018

Martin Wise

August 31, 2018

Martin Wise

August 31, 2018

Martin Wise

August 31, 2018

1. Save Time: Payroll can be very strenuous with the

mass amount of operations needed to keep everything in order.

Calculating hours, tax preparation and employee data maintenance can

take multiple hours to complete when it's done manually. Investing in a

good payroll system will allow information such as direct deposits pay,

up to date tables, and even updating your general ledger to be

automated.

2. Reduces Human Error: When businesses manually

enter employee wages, there is always the possibility of human error.

Use a payroll system to reduce human error is and save the company

money.

3. Always Up-To-Date with Taxes: When tax season is approaching it can take hours to ensure that all information that has been entered manually is correct. Payroll systems will always have the tax tables up-to-date, so your business will always be compliant without the added stress.

4. It is secure. One of the most essential features that a payroll system needs is security. Payroll contains very sensitive data, which is kept confidential and can be stored away safely in the cloud. The only person who has access to this data is granted permission through role assignments.

5. Easy Integration: It is important to have your systems talk to each other. Your ERP system and payroll system go hand in hand. Payroll software can easily be integrated with well-known systems such as Microsoft Dynamics 365 Business Central.

Microsoft Dynamics Business Central is an all in one system that allows businesses to work digitally and became scalable. Insight Works has developed a Canadian Payroll add-on that integrates with Dynamics 365 Business Central. Join our Canadian Payroll with Microsoft Dynamics 365 Business Central Webinar to learn how their system makes the whole process of employee administration and finance much easier.

Five Reasons Why You Need A Payroll System

Martin Wise

August 31, 2018

Martin Wise

August 31, 2018

Martin Wise

August 31, 2018

Martin Wise

August 31, 2018

If you’re a small business owner or you’re just starting out, like

many, you may think there’s no benefit in having a website when you can

do everything on social media. Or maybe you think you can’t afford a

professional website so you get a freebie and do it yourself instead.

Perhaps you’re in the generation that didn’t grow up with computers,

you don’t use a computer so you think your customers don’t use

computers. You think if you are not tech savvy why bother with a

website. But even if you are an established business that has relied on

word of mouth and think you are doing quite well thank you, there are

several reasons why your business needs a professional website too.

I believe, even with all that you can do on social media, and even if

you’ve been in business for several decades, unless you do not want to

grow your business or you’re about to retire and travel the world, your

business needs a website and preferably one that is professionally

designed and developed.

2. IT SAVES YOU MONEY IN THE LONG TERM

As a small business owner, especially one that is just starting out,

you’re probably thinking you can’t afford a professional website. But

you really can’t afford NOT to. Although the cost of designing a website

varies depending on your needs and your skill level, once it’s up and

running, a professional website is worth the initial investment,

especially if built using WordPress, which enables you to add and change

your own content regularly, saving you money in updates.

Compared with the cost of traditional means of advertising, such as

newspaper ads, radio commercials, promotional materials and even

networking events that often include the cost of a meal or trade tables,

when you consider the potential market you can reach with a website, it

is a very cost effective way to promote your business long term.

Even if your skill levels are slim to none and you need to

continually pay your website designer/developer to maintain and update

your website for you, the upkeep costs are still lower than ongoing

traditional marketing, and the investment is certainly worth the number

of potential customers that will find your business online each year.

When it comes to comparing the cost of a professional website with a

freebie D.I.Y. website, unless you are fairly skilled, your website will

cost you in time and effort that could be better spent elsewhere in

your business. Not only that, but if it’s not professional, or can’t be

found in a Google search, you will lose customers and that will also

cost you dearly.

Saving money is definitely a great reason why your business needs a professional website, but there are several more reasons.

Why Your Business Needs A Professional Website

Martin Wise

August 31, 2018

Martin Wise

August 31, 2018

Martin Wise

August 31, 2018

Martin Wise

August 31, 2018

The

Detailed Payroll has been developed with the capacity and functionality

to enable the accountant or the Hr to keep and maintain employee(s)

payroll information for the whole year. Each employee has their own

account to run the monthly payroll computations and generate a

professional payslip for each.

Detailed Payroll

Martin Wise

August 30, 2018

Martin Wise

August 30, 2018

Martin Wise

August 30, 2018

Martin Wise

August 30, 2018

The nuraphone learns your hearing in about one minute. The first time you put on the nuraphone, it plays a short series of tones. As your ear hears these tones, your inner ear actually produces a tiny sound in response. This tiny sound is called the Otoacoustic Emission (OAE) and it tells the nuraphone what tones your ears are more or less sensitive to.

The nuraphone uses 6 extremely sensitive microphones to detect this returning sound and automatically creates your unique hearing profile.

With your hearing profile applied, you’ll hear your favourite music like never before.

Your unique profile is stored within the nuraphone allowing you to listen to any device with your perfect sound. Up to three profiles can be stored on your nuraphone at any time.

nuraphone - Wireless Bluetooth Over Ear Headphones with Earbuds. Creates Personalised Sound for You. 20 Hour Battery Life. Software Upgrade 16 July - New &...

Martin Wise

July 24, 2018

Martin Wise

July 24, 2018

Martin Wise

July 24, 2018

Martin Wise

July 24, 2018